Contents

The technique used to do this charting is like one brick is placed when the price moves upward or downward compared to the previous brick and by enough value. This value must be reached by the price of the instrument in question for warranting the X and O. There is no usage of time in this graph and if there is no movement in price, no change in the chart as well. As the name suggest, line charts are one of the most common forms of charting pattern. In this, you will find single lines starting from the left side of the graph and moves towards the right.

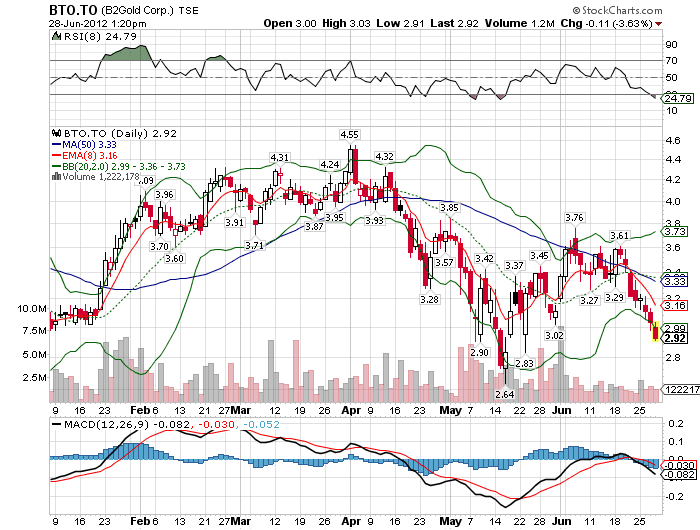

You must make use of the same for better prediction of the price. Historical price and volume data are plotted on the charts on the basis of time intervals. There are multiple chart patterns based on time-intervals as well as other parameters that we will discuss in the next segment. Watching a graph prime cost items list and analyzing from the same can be easy in contrast to an endless list of numbers, isn’t it? Since technical analysis represents everything on graphs, it becomes easier for the trader to look for the specific price and volume points and analyst them without getting confused among all the noise.

In Canada the industry is represented by the Canadian Society of Technical Analysts. In Australia, the industry is represented by the Australian Technical Analysts Association , and the Australian Professional Technical Analysts Inc. Other pioneers of analysis techniques include Ralph Nelson Elliott, William Delbert Gann, and Richard Wyckoff who developed their respective techniques in the early 20th century. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. After looking at all the aspects of Technical Analysis you can understand that this is beneficial for those who are into the daily trading business. So, two individual analysts having their own personal biases will end up interpreting the same chart in two different ways.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The Structured Query Language comprises several different data types that allow it to store different types of information…

Systematic trading

Nonlinear prediction using neural networks occasionally produces statistically significant prediction results. These two can be referred to as one of the most important concepts of technical analysis. If you listen to the analysts speaking in the interviews or talking about daily price movements of stocks on TV, you must have come across these two terms, haven’t you? Ok, so support and resistance are two levels which once broke, tend to a trend reversal as per the technical analysts. Based on the past Chart statistics, forecast of future price movements can be easily done.

As human psychology never change, and human react in the same manner they reacted in the past, so will the market, isn’t it? Supposedly, you were doing Technical Analysis Sensex, five years back when the new government was formed, Sensex rose drastically. For instance, the strategy mentioned above is good for stocks that are highly liquid and volatile. The process is like identify a trend, invest or trade when the trend is ongoing and when it unfolds, you will receive the profits.

- We understand the thought process behind these patterns and how to setup trades based on these patterns.

- The core assumption is that all known fundamentals are factored into price; thus, there is no need to pay close attention to them.

- Because the principles of technical analysis are universally applicable, each of these levels of analysis can be performed using the same theoretical background.

- Moving average is a simple technical analysis indicator used to detect the price trend.

After line charts, Bar charts are very popular amongst the traders. It is a basic tool for this analysis and it presents all the four important prices of a stock. Charts, as you may know, are numbers presented graphically to understand certain parameters. Here, charts represent the price and volume of the stocks and markets. Now after five years, when the election happens and again the party wins, the market will react almost in the same manner. So, you can predict the price movement and the direction of it by checking the five-year-old data.

Trading with Mixing Indicators

Many traders prefer candlestick charts because they are easy to understand and have two hundred years of tradition behind their predictions, making them a more diverse and stable predictor. However, all charting has a place and a purpose, and there are pros and cons to every type of chart. The oldest known form of technical analysis is known as candlestick analysis.

It can be placed in a matter of minutes or take more than a day depending on market conditions. Specifically for traders who desire a simple way of identifying supports and resistances, the overall trend and filter noise. On the other hand, this can make market sentiment hard to determine. Consequently rendering the usage of other analysis tools useless. While this kind of chart doesn’t provide much insight into intraday price movements, many traders consider the closing price to be more important than the open, high, or low price within a given period. You should choose a stock that has strong fundamentals and let the technical analysis also aid your buying decision.

Top-Down Technical Analysis

Though, instead of closing price other price variables like opening prices, high or low prices can be used but for most accurate prediction, closing prices are graphed in this chart. This is a specialized course for technical analysis enthusiast and who wants to become a market analyst or technical analyst. This is a course with acceptance from across different parts of the world. Advanced Technical Analysis covers a broad spectrum and it includes each and everything that you can think about predicting future prices of the stocks. Technical Analysis for Beginners may seem to be tough but it is very important to understand and trade in the market. There are different things that a beginner needs to keep in mind while entering the market using technical analysis skills.

Excellent, easily digestible and key fundamental concepts explained on technical analysis and investing for beginners. 22.1 Trade from charts If you are familiar with Zerodha’s trading terminal, Kite, you probably know that you can choose to analyze stock/index charts either on Tradingview or on ChartIQ. Starting with the basics of the construction of the Fibonacci sequence, we also learn about the derivation of the Golden Ratio.

The Fibonacci retracement provides excellent opportunity for the traders .. In this chapter we understand how two or more candlesticks can be combined to identify trading opportunities. To begin with we understand the bullish and bearish engulfing pattern with real examples f .. Detailed description on the Bullish and Bearish Marubozu with real examples from Indian markets. The chapter discusses how to identify and set up a trade based on Marubozu.

Technical Analysis + Option Strategy (Combo)

In most charting platforms, the most you can display with a candlestick chart is less than what you can with a bar chart. The wider part of the candlestick is shown between the opening and closing price. It is usually colored in black/red when the security closes on a lower price and white/green the other way around. Making long term gains is after all, one of the more common investment strategies.

He described his market key in detail in his 1940s book ‘How to Trade in Stocks’. Livermore’s system was determining market phases (trend, correction etc.) via past price data. He also made use of volume data (which he estimated from how stocks behaved and via ‘market testing’, a process of testing market liquidity via sending in small market orders), as described in his 1940s book. Using data sets of over 100,000 points they demonstrate that trend has an effect that is at least half as important as valuation. The effects of volume and volatility, which are smaller, are also evident and statistically significant.

In compliance with GDPR, currently, basic features are available on Technical Charts platform in EU region. You will not be able to save your preferences and see the layouts. Answer – Technical analysis can be learned by beginners in a short span. It is not as easy as one would think but nothing as extravagant that cannot be achieved as well.

You don’t need an economics degree to analyze a market index chart. It does not matter whether you are looking at a stock, market index or commodity. The technical principles of support, resistance, trend, trading range and other aspects can be applied to any chart. As simple as this may sound, technical analysis is far from easy.

Whenever you are trying to trade directions from the weekly chart, make sure to synchronise it with the daily chart to time entry. As the analysis depends on the historical prices when the trend is identified, a good portion of the price has already moved up. If we follow the books and journals, then Charles Dow developed the concepts of technical analysis.

Bullish white bricks and Bearish black bricks are used in this chart also. When the prices move more than the last brick size, then a new brick is added. This chart is not related with time and is very useful to know the current trend by providing clear indication.Further, it also eliminates the noise factor created by the price movements. The brick positions will remain same without any change if the price movements are not up to the expected level. Moving average is a simple technical analysis indicator used to detect the price trend. Learn about the moving average and a how to set up a simple moving average trading system.

These two levels help the traders understand the price movements and if there is any hint of a trend reversal. This, in turn, helps them act quickly and book profits and trade in the right direction. It becomes easy to understand the price movements as no other factors are influencing the price as per the technical https://1investing.in/ analysis. They think that the demand and supply of the share incorporate all other information of the company and the market. The most important advantage of using technical analysis is the fact that it is purely based on price – market price. The traders and the analysts only focus on the price of the stock.

Just as with fundamental analysis, technical analysis is subjective and our personal biases can be reflected in the analysis. It is important to be aware of these biases when analyzing a chart. If the analyst is a perpetual bull, then a bullish bias will overshadow the analysis.